Project Description:

Provide a platform for users who own digital currency but do not have a US stock account, allowing them to purchase US stocks using digital currency.

Background:

About two weeks before Trump’s election victory, I believed that Trump was very likely to win. Therefore, I wanted to buy some Tesla stocks. However, since I had never thought about buying US or Hong Kong stocks before, I never opened an account. By the time I was ready to go to Hong Kong to open an account on Saturday, it was too late, and Tesla had already surged. This made me miss a great opportunity to make money!

After the regret, I thought about this: Are there many people (domestically or globally) like me who own digital currency, understand digital currency trading, but do not have an account for US stocks (or other stock markets)? At some point, they want to buy a particular stock but miss the opportunity because they don’t have an account. For such a user group, can digital currency become a bridge to complete the transaction?Thus, this project idea was born.

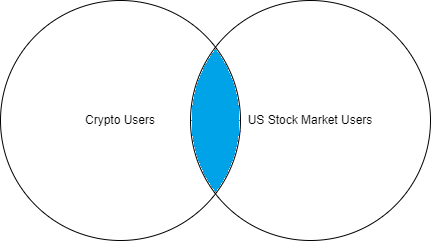

However, I am not sure if this group is large enough or if it is a pseudo-demand.

In theory, the smaller the blue section, the greater the potential opportunity.

Additionally, to complete this project, I believe at least the following points need to be considered:

- Whether such a project, which is strongly related to the financial market, has legal risks. From the perspective of laws and regulations, is it feasible?

- The stock trading market follows T+1, T+2 rules, so the trading process needs to be well designed.

- One of the project’s profit points is definitely the handling fee, but this fee needs to cover the cost of the transaction fees paid during stock trading. In this way, will users spend too much on fees?

Welcome to the discussion!

一句话描述项目的功能:为拥有数字货币,但是没有美股账号的用户,提供一个平台让他们可以使用数字货币购买美股。

背景介绍:

在特朗普胜选前两周左右,我认为特朗普大概率会胜选。因此我想购买一些特斯拉的股票,但是由于我之前一直没有过买美股或者港股的想法,所以一直没有开户。等到我准备在周六去香港开户时,已经晚了,特斯拉已经大涨了。这让我错失了一个赚钱的好机会!

遗憾过后,我想到了这样一点,是否(国内or全球)存在很多类似于我这样的人,拥有数字货币,懂得数字货币交易,但是没有开美股(或者其他股票市场交易平台)的用户。在某一刻想去买某个股票,却因为没有开户而错失时机呢?对于这样的用户群体,能不能让数字货币成为完成交易的桥梁?于是有了这样的一个项目想法。

不过我不知道这样的群体大不大,会不会是伪需求~

理论上:蓝色部分越小,潜在的机会越大。

另外,要完成这个项目。我认为至少还需要考虑以下这些点:

- 这样一个和金融市场强相关的项目,是否存在法律风险。从法律法规的角度来讲,是否存在可行性。

- 股票交易市场是T+1, T+2的规则,在交易的流程上应该是需要好好设计一下的。

- 项目的盈利点之一肯定是手续费,但是这个手续费我们需要能够覆盖在股票交易时支付的手续费成本,如此一来,用户是否会在手续费上支出过多?

欢迎大家讨论~